Smoothed Moving Average - SMMA

Moving averages are amongst the most widely used tools by participants in the currency markets. The strength of a moving average is its ability to filter out price noise reducing what can be extremely volatile price series into more discernible trends, thereby allowing traders to ascertain the strength and direction of the trend. Moving averages smooth past price data to form trend following indicators and are a component in many other technical indicators including the MACD, the DeMarker and the Directional Movement System amongst many others.

The SMMA gives recent prices an equal weighting to historic prices. The calculation takes all available data series into account rather than referring to a fixed period. This is achieved by subtracting the prior periods SMMA from the current periods price. Adding this result to yesterday’s Smoothed Moving Average gives today’s Moving Average.

The first value for the Smoothed Moving Average is calculated as a Simple Moving Average (SMA):

SUM1=SUM (CLOSE, N)

SMMA1 = SUM1/ N

The second and subsequent moving averages are calculated according to this formula:

SMMA (i) = (SUM1 – SMMA1+CLOSE (i))/ N

Where:

SUM1

– is the total sum of closing prices for N periods;

SMMA1 – is the smoothed moving average of the first bar;

SMMA (i) – is the smoothed moving average of the current bar (except the first

one);

CLOSE (i) – is the current closing price;

N – is the smoothing period.

Type to use

Moving averages are commonly used to identify trends and reversals as well as identifying support and resistance levels. Moving averages such the WMA and EMA, which are more sensitive to recent prices (experience less lag with price) will turn before an SMA. They are therefore more suitable for dynamic trades, which are reactive to short term price movements. Moving averages such as the SMA move more slowly providing valuable information on the long dominant trend. They can however be prone to giving late signals causing the trader to miss significant parts of the price movement.

Trade Signals

Moving Average Crossovers: Moving average crossovers is a term applied when more than one moving average is used to generate a trade signal where traders will act when the shorter term moving average crosses the longer term moving average. A bullish crossover occurs when the shorter term moving average crosses above the longer term moving average (golden cross). A bearish crossover occurs where the shorter term moving average crosses below the longer term moving average (dead cross).

Price crossovers: A Price crossover is a term applied when a signal is generated where the price crosses a moving average. Bullish signals are given when the price moves above the moving average, bearish signals are given when the price moves below the moving average. Crossover trades are more likely to enjoy success when the moving average slopes are in the direction of the trade.

Support and Resistance: Moving averages can also act as a support level in an uptrend and resistance levels in a downtrend. If the average is widely followed orders in favour of the trend often cluster around the average. As markets are often driven by emotion and many players trade counter to the trend expect overshoots, to this extent the average should be used to identify support and resistance zones rather than exact levels.

A Smoothed Moving Average is an Exponential Moving Average, only with a longer period applied. The Smoothed Moving Average gives the recent prices an equal weighting to the historic ones. The calculation does not refer to a fixed period, but rather takes all available data series into account. This is achieved by subtracting yesterday’s Smoothed Moving Average from today’s price. Adding this result to yesterday’s Smoothed Moving Average, results in today’s Moving Average.

Period. The number of bars in a chart. If the chart displays daily data, then period denotes days; in weekly charts, the period will stand for weeks, and so on. The application uses a default of 9. However, to smooth the Moving Average, the period specified is lengthened: Period=2*n-1.

Aspect: The Symbol field on which the study will be calculated. Field is set to “Default”, which, when viewing a chart for a specific symbol, is the same as “Close”.

A Smoothed Moving Average is another type of Moving Average. In a Simple Moving Average, the price data have an equal weight in the computation of the average. Also, in a Simple Moving Average, the oldest price data are removed from the Moving Average as a new price is added to the computation. The Smoothed Moving Average uses a longer period to determine the average, assigning a weight to the price data as the average is calculated. Thus, the oldest price data in the Smoothed Moving Average are never removed, but they have only a minimal impact on the Moving Average.

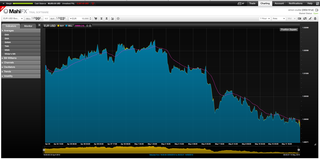

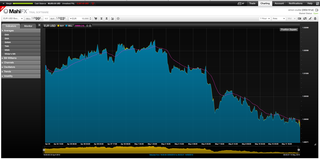

The main use of this study is its smoothing out function. In this way, the Moving Average removes short-term fluctuations and leaves to view the prevailing trend.

Moving Averages work best in trending markets. A buy signal occurs when the short and intermediate term averages cross from below to above the longer term average. Conversely, a sell signal is issued when the short and intermediate term averages cross from above to below the longer term average. You can use the same signals with two Moving Averages, but most market technicians suggest using longer term averages when trading only two Smoothed Moving Averages in a crossover system.

Another trading approach is to use the current price concept. If the current price is above the Smoothed Moving Averages, you buy. Liquidate that position when the current price crosses below either Moving Average. For a short position, sell when the current price is below the Smoothed Moving Average. Liquidate that position when the current price rises above the Smoothed Moving Averages.

As you use Smoothed Moving Averages, do not confuse them with Simple Moving Averages. A Smoothed Moving Average behaves quite differently from a Simple Moving Average. It is a function of the weighting factor or length of the average.